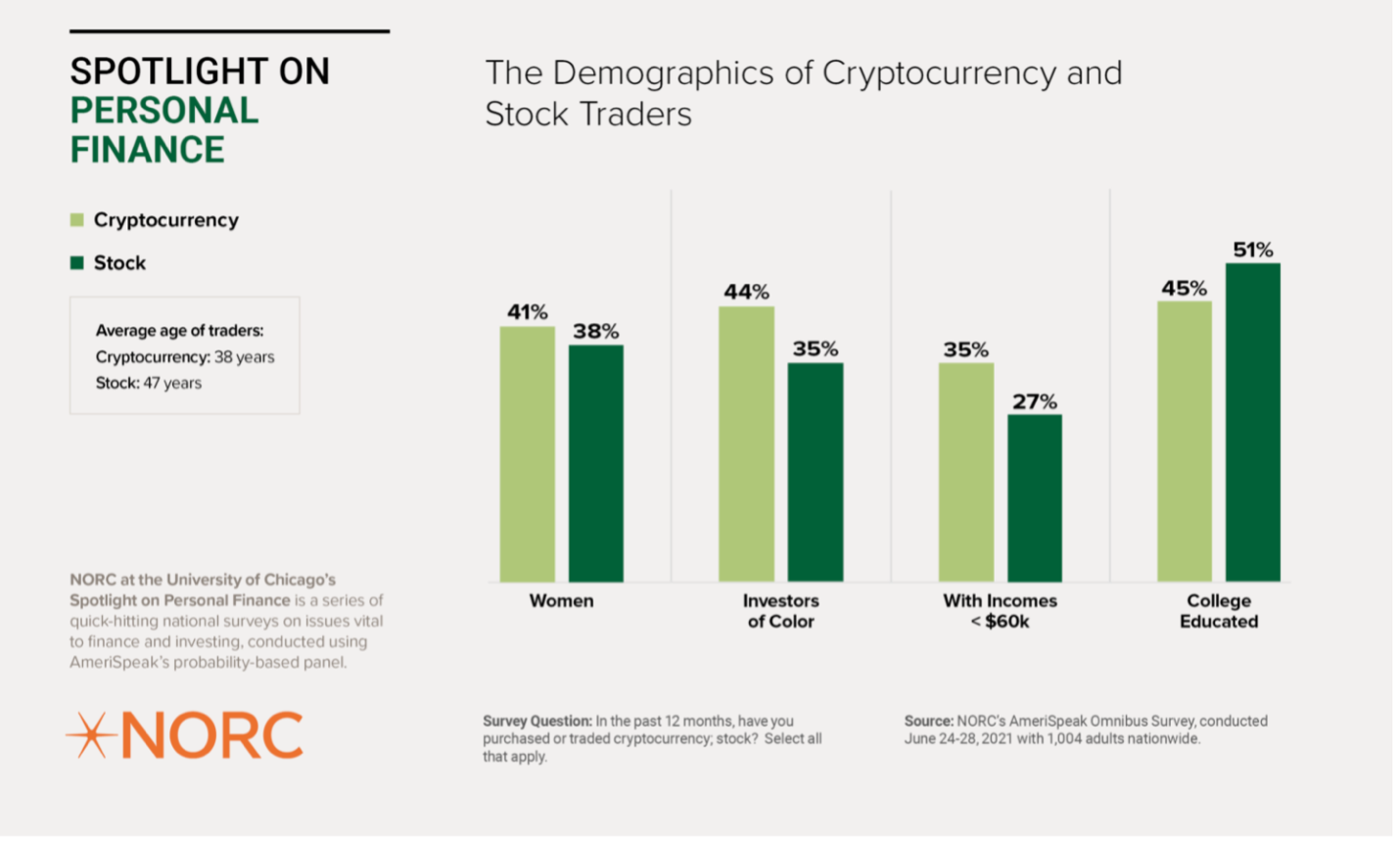

Crypto has gone mainstream with the volatile prices of digital currencies routinely generating headlines and whiplash for exuberant investors. 13 percent of Americans surveyed by the National Opinion Research Center (NORC) at the University of Chicago reported purchasing or trading cryptocurrencies within the past year, and the majority (61 percent) started doing so sometime between February 2021 and July 2021. Cryptocurrency traders tend to be younger, more diverse and less wealthy than stock market investors,[1] but wealthier individuals and institutions also recognize crypto’s potential. 45 percent of the ultra-rich clients of Goldman Sachs view crypto as a hedge against higher inflation and low-interest rates.[2]

The crypto market’s risks, opportunities and thrills resemble the California Gold Rush of the mid-1800s, complete with absent or conflicting regulations, passionate fortune seekers, hucksters and volatility. If we look beyond tales of FOMO-driven buying and panic-driven selling, we see how the crypto market consists of distinct segments built on blockchain, a transformative distributed database and digital ledger technology.

Blockchain technology records data points chronologically and linearly across a network of computers or internet-connected devices called nodes. Decentralized blockchains have no need for administrators or intermediaries between nodes, while private blockchains use nodes owned and operated by a particular entity or set of entities.

As distributed digital ledgers, blockchains are meant to provide an immutable source of truth. The digitized data points in each block are timestamped and associated with a unique string of letters and numbers. Each node carries the blockchain’s entire history, so tampering with the record after the fact would require altering the data in the majority of nodes. In decentralized blockchains with thousands of nodes, this feat is nearly impossible currently. Nodes verify their data using the data stored in the blockchain’s other nodes to maintain consensus.

Let’s examine three segments of the crypto market and how each uses blockchain technology.

Coins

Cryptocurrencies use blockchains to document financial transactions between users without intermediaries. Bitcoin, the best-known cryptocurrency, uses a “proof of work” mechanism where miners operating nodes validate transactions in exchange for Bitcoin. Many, if not most, other cryptocurrencies such as Ethereum were designed to solve the challenges or pitfalls associated with Bitcoin. An exception might be Dogecoin, which originated as a way to make fun of cryptocurrencies while entertaining an eccentric centibillionaire.[3]

Tokens

As we’ve discussed, blockchains can record more than financial transactions. Blockchain technology can also facilitate the exchange of digital tokens, which can represent a diverse array of assets, including currencies, DNA[4], music[5], energy, tasks, time, actions and nearly anything given connectivity as part of the Internet of Things (IoT). Tokens can be fungible and tradeable or they can be Non-Fungible Tokens (NFTs) which are meant to represent a unique asset.

We previously mentioned Ethereum as a digital coin, but it also serves as a platform for smart contracts and distributed, decentralized applications. Applications running on the Ethereum blockchain use a token called Ether to document the state and history of an asset. Microsoft recently published a white paper describing how it could utilize the Ethereum blockchain to mitigate digital piracy.[6] New York-based startup LO3 developed a platform based on the Ethereum blockchain to enable users to track and sell locally generated renewable electricity directly to their neighbors. If a person with solar panels generates more energy than their home can use, they can sell a token representing the excess electricity.[7]

SERVICES

Some of the greatest successes in the aforementioned California Gold Rush were providers of ancillary services. Examples include Studebaker, which made wheelbarrows for miners long before it made cars, Levi Strauss, which made wagon tarps and denim jeans, and Wells Fargo, which provided mail and freight services followed by a bank that bought gold dust from the miners. The crypto market teems with ancillary service providers, including crypto exchanges like Coinbase and KuCoin, distributed application developers and emerging cryptocurrency index funds.

Environmental Impact and Sustainability Concerns

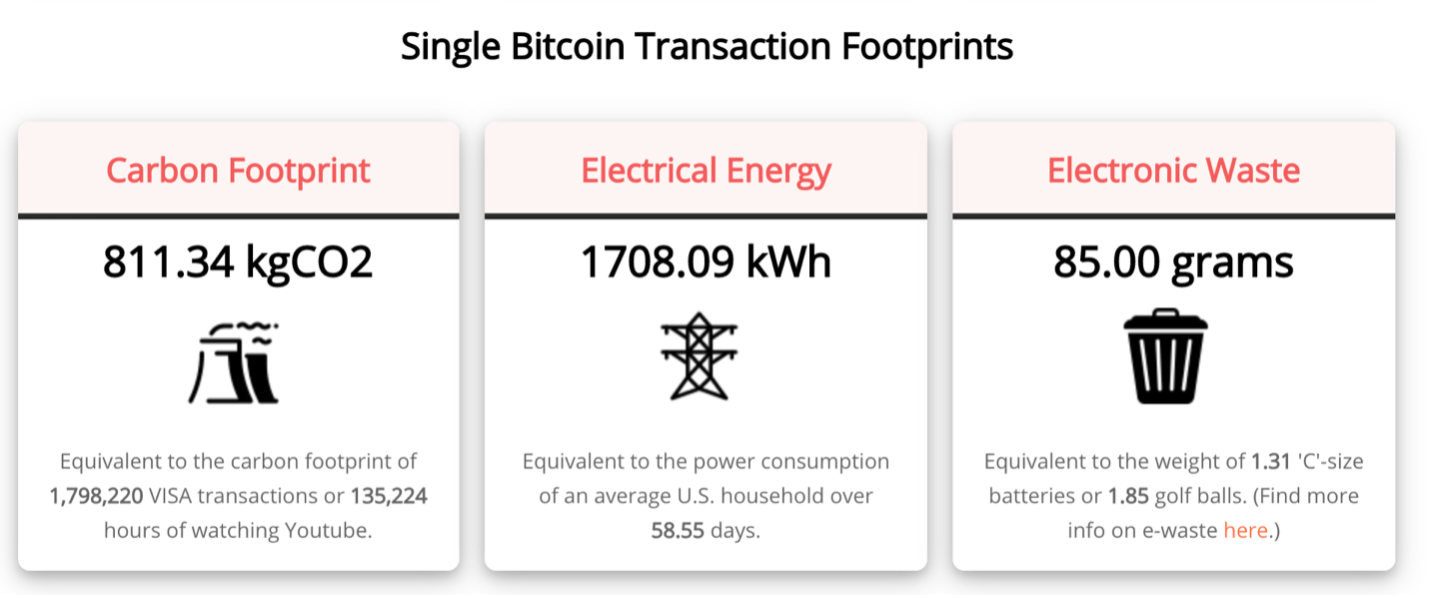

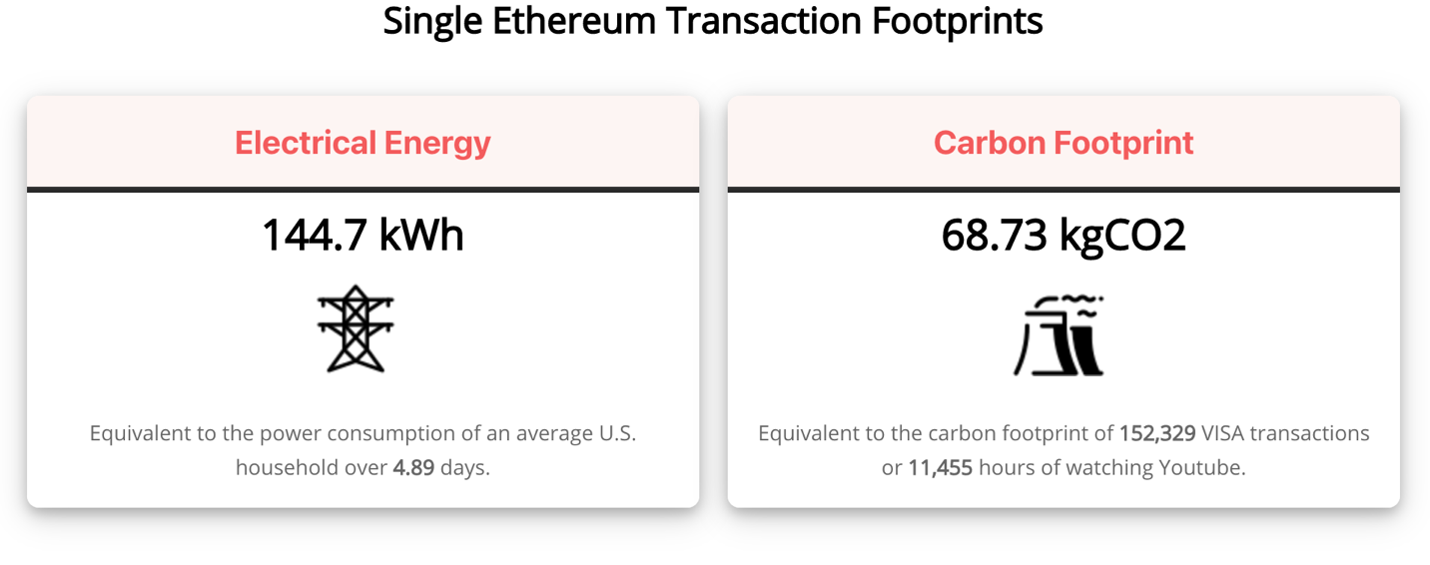

Bitcoin’s proof of work method is energy-intensive, with each transaction consuming as much power as the average U.S. household over 58.52 days.[8] Miners can only update the ledger of Bitcoin transactions after expending significant computational resources to find the solution to a challenge, which must then be mathematically validated by the other network nodes. Thousands of miners all around the world participate in this process for every single transaction and together their computers create a huge carbon footprint with their energy consumption. Some alternative cryptocurrencies, or altcoins, attempt to mitigate this challenge by requiring less energy-intensive processes to validate transactions . For example, a single Ethereum transaction consumes as much power as the average U.S. household over 4.86 days.[9] Neither figure will excite anyone feeling jittery after the latest IPCC report.[10] But baby steps are better than nothing.

Source: Digiconomist, Bitcoin Energy Consumption Index

Source: Digiconomist, Ethereum Energy Consumption Index

While energy consumption and the resulting carbon emissions are the primary knocks against Bitcoin, altcoins may seek to increase transaction speeds compared to Bitcoin, optimize cryptocurrency for specific regions or verticals (e.g., telecommunications) or reduce the impact of cryptocurrency volatility. Stablecoins are an example of the latter and peg their value to a fiat currency or a stable store of value to mitigate volatility.[11]

Evermay’s view

Much of the media hype surrounding crypto has focused on digital coins and tokens. In these segments, we encounter spectacular price swings and dramatic storylines in the asset market Minneapolis Federal Reserve President Neel Kashkari describes as “95 percent fraud, hype, noise and confusion.”[12] Come to gawk at the volatility and Elon Musk’s antics and stay for Warren Buffet calling Bitcoin “rat poison squared.”[13] In our opinion, it’s difficult to define who the winners and losers might be within these two segments.

The rapidly evolving ancillary services area is more interesting to us but may take many years to bear fruit. While we monitor funds in this segment, the persistent lack of regulation and the possibility of new government restrictions and heavy taxes on crypto make us hesitant to recommend them for client portfolios at present. Given how quickly the crypto market evolves, this view may change tomorrow – for better or worse.

Evermay is closely following this emerging space as opportunities develop. Stay connected with us, and feel free to send us any of your questions.

Blog commentary represents a snapshot in time and is subject to change.

_______________________

[1] NORC, More Than One in Ten Americans Surveyed Invest In Cryptocurrencies https://www.norc.org/NewsEventsPublications/PressReleases/Pages/more-than-one-in-ten-americans-surveyed-invest-in-cryptocurrencies.aspx

[2] Benzinga, Nearly Half Of Goldman Sachs' 'Ultra-Rich' Clients Want Crypto In Their Portfolios https://www.benzinga.com/markets/cryptocurrency/21/07/22097589/nearly-half-of-goldman-sachs-ultra-rich-clients-want-crypto-in-their-portfolios

[3] CNBC, Dogecoin rallies after Elon Musk agrees with Mark Cuban that it's the 'strongest' cryptocurrency as a medium of exchange https://www.cnbc.com/2021/08/16/dogecoin-rallies-after-mark-cuban-and-elon-musk-agree.html

[4] Wired, These DNA Startups Want to Put Your Whole Genome on the Blockchain https://www.wired.com/story/these-dna-startups-want-to-put-all-of-you-on-the-blockchain/

[5] Revolt, Benny the Butcher releases “The Plugs I Met” NFT album https://www.revolt.tv/new-music/2021/8/13/22620719/benny-the-butcher-the-plugs-i-met-album

[6] Business Insider, Microsoft is looking to use the ethereum blockchain to prevent piracy https://markets.businessinsider.com/news/currencies/microsoft-msft-ethereum-blockchain-fight-piracy-digital-tech-public-ledger-2021-8

[7] Forbes, Shell Invests in Ethereum Hybrid That Gives Real Power to the People https://www.forbes.com/sites/michaeldelcastillo/2019/07/10/shell-invests-in-ethereum-hybrid-giving-real-power-to-the-people/?sh=b5357a2c07ab

[8] Digiconomist, Bitcoin Energy Consumption Index https://digiconomist.net/bitcoin-energy-consumption

[9] Digiconomist, Ethereum Energy Consumption Index https://digiconomist.net/ethereum-energy-consumption

[10] Associated Press, ‘Code Red’: UN scientists warn of worsening global warming https://apnews.com/article/asia-pacific-latin-america-middle-east-africa-europe-1d89d5183583718ad4ad311fa2ee7d83

[11] Coinbase, What is a stablecoin? https://www.coinbase.com/learn/crypto-basics/what-is-a-stablecoin

[12] Nasdaq, Minneapolis Fed President Kashkari on Crypto Market: ‘Thousands of Garbage Coins’ https://www.nasdaq.com/articles/minneapolis-fed-president-kashkari-on-crypto-market%3A-thousands-of-garbage-coins-2021-08-17

[13] Business Insider, Warren Buffett blasted Bitcoin as a worthless delusion and 'rat poison squared.' Here are his 16 best quotes about crypto. https://markets.businessinsider.com/news/currencies/warren-buffett-best-quotes-bitcoin-cryptocurrencies-investing-rat-poison-squared-2021-1

Blog commentary and opinions expressed herein represent a snapshot in time and are subject to change. Any discussion or information contained in this blog does not serve as the receipt of, or substitute for, personalized investment advice from Evermay.

Sign Up for the Evermay Newsletter

Stay current on market trends and the latest financial insights—delivered straight to your inbox!