Q2 2021 Recap

“Surprise!” That was the gist of the Federal Reserve’s message to financial markets in the second quarter of 2021, with the mid-June release of its Summary of Economic Projections hinting the Fed may begin raising interest rates next year – decidedly sooner than markets had previously assumed. Fed Chairman Jerome Powell supported this hawkish policy shift with comments suggesting inflation may be running hotter and more persistent than he had previously thought, marking a significant change in attitude from the person who had expressed strong belief that rising inflation would be largely transitory in nature.

Both stock and bond markets reacted negatively at first to the central bank’s apparent policy change, but soon responded with a dismissive message back to the Fed, “Meh.” Tossing aside the threat of rate hikes and soaring inflation data, longer-dated US Treasury yields fell markedly from the recent cycle highs set in March, with the 30-year bond yield dropping from 2.43% to under 1.95%[1] at the time of this writing. Riskier bonds also saw yields fall, with the spread on BBB-rated US corporate bonds dipping to multi-decade lows, offering investors lower returns for taking on credit risk. Stocks quickly rebounded in response to the action in bonds, with the S&P 500 rallying into the end of the quarter and closing at an all-time high.

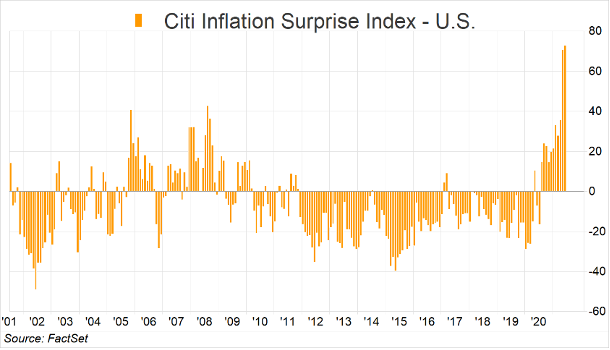

To Chairman Powell’s point, inflation is indeed running hotter than many Wall Street economists had forecast, with the Consumer Price Index up 5.0% for the 12 months ending May 31st,[2] and the Citi Inflation Surprise Index at its highest point ever. The broad economy is also running at a feverish pace, with US real gross domestic product (GDP) accelerating at a 6.4% annualized rate[3] in the first quarter of 2021, and likely faster in the yet-to-be reported second quarter.

Why are bond yields falling with inflation at such high levels? And why does the stock market seem so sanguine with the Fed poised to tap on the brakes and slow the economy? First, there is the notion that inflation may well prove to be transitory, and thus not much of a concern in the long run. Evermay’s view is that some components of rising inflation, such as commodity prices and supply-chain bottlenecks, may indeed prove to be relatively short-lived, while other factors, notably wage growth, could be “sticky” and thus more problematic down the road.

A growing belief, and perhaps a powerful one, is that the economy is already poised to decelerate on its own, negating the need for the Fed to be aggressive in raising rates. We note that lumber prices, the cause of much consternation in the financial media in recent months, have dropped by over 50% since peaking in May.[4] Also, the latest service-sector Purchasing Managers Index (PMI), considered a leading economic indicator, came in below expectations[5], hinting that a slowdown has already begun. Add the possibility of higher corporate and small business taxes into the mix, and the stage seems set for slower growth ahead.

Keep in mind that when we say the economy may decelerate, we are not at all suggesting it may be in decline. However, we do anticipate the rate of growth will slow from recent levels, for both inflation and overall economic activity. While lumber prices are down from recent peaks, they are still well above the average levels of the last five years. Similarly, the service sector PMI is still near the top levels seen over the past decade. At the same time, average earnings for S&P 500 companies are at all time highs and rising – and should continue to do so, at least in the near term.

While we recognize there are uncertainties to any outlook and that surprises may happen, we remain optimistic for the economy and markets for the balance of the year. As always, we encourage you to reach out to discuss your portfolio and ensure the mix of assets is appropriate and aligned with your financial goals.

[1] FactSet

[2] Bureau of Labor Statistics (BLS.gov)

[3] Bureau of Economic Analysis (BEA.gov)

[4] Nasdaq.com (LBS chart)

[5] FactSet

Important Disclosure Information

Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Evermay Wealth Management, LLC [“Evermay]), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Evermay. No amount of prior experience or success should not be construed that a certain level of results or satisfaction if Evermay is engaged, or continues to be engaged, to provide investment advisory services. Evermay is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the Evermay’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.evermaywealth.com.

Please Remember: If you are a Evermay client, please contact Evermay, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.

Sign Up for the Evermay Newsletter

Stay current on market trends and the latest financial insights—delivered straight to your inbox!